Small business owners are constantly juggling tasks, from managing daily operations to making strategic decisions that drive growth. Accounting, a critical element of business management, often gets sidelined or handled in-house by someone without specialized knowledge. This is where professional accounting services can make a tremendous difference. With the expertise of trained accountants, small businesses can gain financial clarity, improve cash flow, ensure compliance, and make more informed decisions that foster long-term growth.

Here’s how small businesses can benefit from professional accounting services and why they’re a smart investment.

Accurate Bookkeeping: The Foundation of Financial Health

Bookkeeping might seem simple, but it forms the backbone of any business’s financial stability. It involves recording daily financial transactions, tracking expenses, managing invoices, and keeping tabs on accounts payable and receivable. Without accurate bookkeeping, even profitable businesses can lose sight of their financial position.

Professional accounting services ensure precise bookkeeping, which translates to better cash flow, reduced errors, and a clear view of financial health. By maintaining detailed and organized records, accounting services also make it easier to prepare for tax season, avoiding last-minute scrambles to locate receipts or balance accounts.

Cash Flow Management: Keeping Your Business Financially Fit

Cash flow issues are one of the leading causes of small business failures. Even profitable businesses can suffer if they lack liquidity or struggle to manage payments and receivables. Professional accounting services help small business owners manage cash flow by tracking when and where money comes in and goes out.

Accountants can analyze cash flow trends, pinpoint periods of high and low revenue, and suggest strategies to maintain a healthy balance. For instance, they might recommend adjusting billing cycles, negotiating longer payment terms with suppliers, or setting up a savings fund for slower seasons. This proactive cash flow management can help small businesses avoid financial strain, maintain a safety net, and ensure that they have funds available for unexpected expenses or investment opportunities.

Tax Preparation and Compliance: Minimizing Stress and Maximizing Savings

Tax compliance is an essential aspect of running a business. Filing taxes correctly and on time not only keeps small businesses out of trouble but also allows them to take advantage of deductions and credits they may not be aware of. Professional accounting services stay updated on the latest tax laws and can help small businesses maximize deductions while ensuring full compliance.

Accountants understand how to navigate complex tax codes, ensuring that all eligible expenses are deducted. They can also help strategize for future tax seasons, allowing business owners to anticipate and prepare for tax liabilities in advance. Additionally, having a professional handle tax-related matters helps reduce stress, allowing business owners to focus on running their business without worrying about penalties, audits, or potential legal issues.

Strategic Financial Planning: Making Informed Decisions for Growth

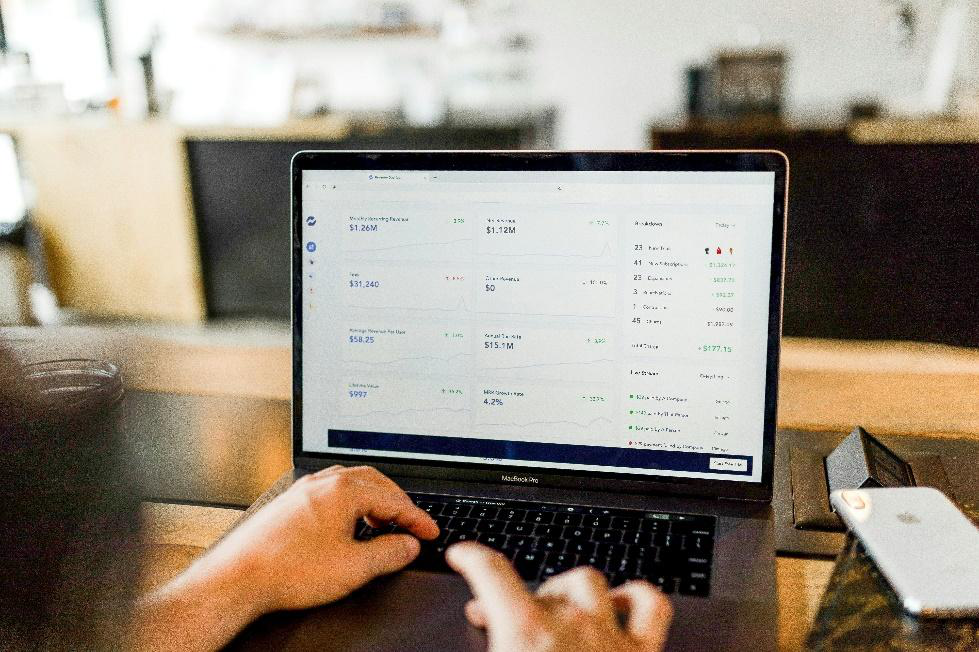

Beyond bookkeeping and tax preparation, professional accounting services can assist with strategic financial planning, which is key to growth and sustainability. Accountants analyze financial data to give insights into a business’s strengths, weaknesses, opportunities, and risks. By understanding where the business stands financially, owners can make data-driven decisions about expanding, investing in new equipment, hiring staff, or launching new products.

For example, an accountant might suggest which products or services are most profitable, allowing the business to focus efforts there. They can also help develop budgets, set financial goals, and create forecasts that guide long-term decision-making. This financial roadmap can be a powerful tool, helping businesses achieve growth milestones with confidence.

Payroll Management: Ensuring Accuracy and Compliance

Handling payroll can be a time-consuming task, especially as a small business grows. Errors in payroll processing can lead to compliance issues, disgruntled employees, and penalties. Professional accounting services streamline payroll management, ensuring employees are paid accurately and on time while also managing tax withholdings, benefits, and deductions.

With professionals handling payroll, small businesses don’t have to worry about miscalculations or keeping up with constantly changing regulations. Accountants also help track payroll expenses as part of the overall budget, ensuring that employee compensation aligns with the business’s financial capacity. By outsourcing payroll to experts, small businesses can save time and avoid the pitfalls of payroll mistakes, promoting employee satisfaction and regulatory compliance.

Time and Cost Efficiency: Focus on Core Business Functions

For small business owners, time is often one of the most valuable assets. By outsourcing accounting tasks to professionals, business owners can reclaim time to focus on what they do best—whether that’s creating products, serving customers, or planning business strategies.

While there’s a cost associated with hiring professional accounting services, the return on investment is often substantial. Accurate bookkeeping, efficient tax preparation, cash flow management, and financial planning can prevent costly errors, improve profitability, and save time. Furthermore, with a clear view of financial data, small business owners can make smarter investments that fuel growth.

Take Your Business to the Next Level

Your trusted Miami Beach CPA Firm offers comprehensive accounting services, from small business tax preparation to precise Bookkeeping Services Miami and Payroll services Miami. Let our experts handle your finances so you can focus on growth.

Contact us today for professional tax preparation and accounting services in Miami.

Effective financial management is crucial for the success of medical practices. In a field characterized by ever-evolving regulations, increasing costs, and a focus on patient care, medical practitioners must adopt efficient financial strategies to maintain compliance and ensure profitability. This comprehensive guide will explore essential elements of financial management for medical practices, emphasizing the importance of efficiency, regulatory compliance, and the benefits of partnering with a professional CPA firm in Miami.

1. Understanding the Financial Landscape

Medical practices operate within a unique financial landscape shaped by various factors, including reimbursement rates, billing processes, and regulatory compliance. Understanding these elements is the first step toward effective financial management for medical practices.

Reimbursement from insurance companies and government programs can significantly impact a practice’s cash flow. Therefore, having a clear grasp of how billing works and ensuring that claims are submitted accurately and promptly is vital. Partnering with experts in accounting services in Miami can help streamline these processes and maximize revenue.

2. Emphasizing Efficient Billing and Collections

A key aspect of financial management is the billing and collections process. Efficient billing ensures that practices receive payment for services rendered in a timely manner. To enhance efficiency, medical practices should:

- Implement an electronic health record(EHR) system that integrates with billing software.

- Regularly train staff on billing procedures and coding updates.

- Monitor accounts receivable closely to identify outstanding payments.

Utilizing payroll services and bookkeeping services in Miami can also help manage billing functions more effectively, reducing the risk of errors and delays.

3. Implementing Robust Financial Controls

To maintain profitability, medical practices need strong financial controls that safeguard their assets and ensure compliance with regulations. Key controls include:

- Segregation of duties: Ensuring that different staff members handle billing, collections, and deposits to prevent fraud.

- Regular financial reporting: Implementing monthly or quarterly financial reviews to monitor performance and make informed decisions.

- Budgeting: Creating an annual budget that aligns with the practice’s goals and expectations.

By partnering with a CPA firm in Miami, practices can benefit from expert business accounting and develop tailored financial controls suited to their specific needs.

4. Navigating Regulatory Compliance

Healthcare is one of the most heavily regulated industries. Medical practices must comply with a myriad of laws and regulations, including those related to billing, patient privacy, and employment practices. To stay compliant:

- Stay informed about changing regulations at the federal and state levels.

- Utilize compliance checklists to ensure adherence to legal requirements.

- Conduct regular internal audits to assess compliance levels and identify areas for improvement.

Engaging in tax planning and seeking tax resolution services in Miami can provide practices with insights into compliance obligations and minimize exposure to penalties.

5. Optimizing Cash Flow Management

Effective cash flow management is crucial for medical practices. Ensuring that cash inflows align with outflows helps maintain financial stability. Key strategies include:

- Establishing clear payment policies for patients and insurers.

- Offering payment plans or financing options for patients who may struggle to pay their bills upfront.

- Regularly reviewing cash flow statements to anticipate shortfalls.

Utilizing QuickBooks setup in Miami or other accounting software can streamline cash flow management by providing real-time insights into financial performance.

6. Leveraging Technology for Financial Management

Technology plays a vital role in modern financial management. Utilizing advanced accounting software can simplify tasks, enhance accuracy, and improve efficiency. Key technologies include:

- Accounting software: Tools like QuickBooks, SAP accounting in Miami, and Oracle accounting can automate many financial processes.

- EHR systems: Integrating financial management with patient records ensures seamless billing and improves overall efficiency.

- Data analytics: Leveraging analytics tools to assess financial performance and identify trends can aid in strategic decision-making.

Accounting software consulting in Miami can assist practices in selecting and implementing the right technology for their needs.

7. Preparing for Tax Obligations

Tax season can be stressful for medical practices, especially with the complex regulations governing healthcare. To minimize the stress associated with tax preparation, practices should:

- Keep accurate and up-to-date financial records throughout the year.

- Engage inindividual tax preparation in Miami for personal tax obligations, ensuring that all tax credits and deductions are maximized.

- Utilize business tax preparation in Miamiservices to ensure compliance and accuracy in filing business taxes.

Additionally, regular meetings with a CPA service in Miami provider can help practices stay informed about potential tax liabilities and changes in regulations that may affect their finances.

8. Investing in Staff Training and Development

Well-trained staff can significantly impact a practice’s financial performance. Investing in continuous education and training helps ensure that team members are up-to-date with the latest billing procedures, coding changes, and compliance regulations.

Conducting QuickBooks training Miami for staff involved in financial management ensures that they can utilize the software effectively, reducing errors and enhancing overall efficiency.

Elevate Your Medical Practice’s Financial Management

At Miami Beach CPA Firm, we understand the unique financial challenges faced by medical practices. Our expert team is here to provide tailored accounting services in Miami that enhance your practice’s efficiency and compliance. Let us help you transform your finances and focus on delivering exceptional patient care. Contact us today to get started!

Effective financial planning is crucial for small businesses, and payroll services play a significant role in this process. Continue reading “The Role Of Payroll Services In Financial Planning For Small Businesses”

Does managing your business’s payroll feel like navigating a minefield? Ensuring accurate and timely payments, staying compliant with regulations, and keeping your team happy can seem daunting. But it doesn’t have to be! With the right strategies, you can transform payroll management from a stress-inducing chore into a smooth and efficient process that not only meets but exceeds expectations.

At Miami Beach CPA Firm, we specialize in refining payroll processes to enhance compliance and employee satisfaction. Our approach ensures that your payroll system adheres to the latest regulations and supports your company’s broader financial strategy.

Let’s explore some of the best practices in business payroll management that help you sidestep common pitfalls and enhance employee satisfaction. These tips are designed to streamline your operations and create a payroll system that is both robust and user-friendly.

Setting Up a Reliable Payroll System

Establishing a reliable payroll system is foundational to managing your workforce effectively. Let’s look at how choosing the right tools and training can simplify this critical business function.

Choose the Right Software:

Finding the perfect payroll software can feel like a quest, but it’s a vital step for business efficiency. Tools like QuickBooks and Peachtree not only streamline payroll processes but also adapt as your business grows. At Miami Beach CPA Firm, we help you select and implement the most effective software that fits seamlessly into your business operations.

Regular Training and Updates:

Keeping your payroll team proficient with the latest software features and compliance requirements is crucial. We conduct QuickBooks training in Miami to ensure your staff is well-versed in using these tools effectively, minimizing errors, and enhancing payroll efficiency.

Enhancing Compliance and Accuracy

Compliance is a critical component of payroll management. Ensuring accuracy and adhering to legal standards can protect your business from costly penalties.

Stay Informed on Regulations:

Payroll compliance is about more than just following rules; it’s about safeguarding your business against financial penalties and legal issues. With our payroll services in Miami, we keep up-to-date with the latest state and federal tax laws and employment regulations to ensure your payroll system meets all legal standards. This proactive approach helps you avoid potential fines and ensures peace of mind.

Implement Rigorous Checks and Balances:

Accuracy in payroll is non-negotiable. Our team conducts regular audits and reviews of your payroll processes to identify and correct discrepancies swiftly. These measures maintain the integrity of your payroll operations and safeguard your business from costly errors.

Streamlining Payroll Processing

Streamlining payroll processing can significantly enhance the efficiency of your business operations. Here’s how automation and regular reviews can improve your payroll system.

Automate Where Possible:

Automation is key to reducing the manual burden of payroll tasks. We advise on the best automation tools that fit your business needs, helping you streamline data entry, calculations, and payments. This not only cuts down on errors but also frees up your time to focus on core business activities.

Schedule Regular Payroll Reviews:

Consistency and reliability in payroll are achieved through diligence. We encourage regular review sessions to ensure each payroll cycle runs smoothly and any issues are addressed promptly. This proactive measure not only streamlines operations but also builds trust among your employees.

Building a Responsive Payroll Team

A responsive payroll team is essential for effective payroll management. Encouraging open communication and ongoing support can elevate your team’s performance.

Encourage Open Communication:

Open lines of communication between payroll staff and other departments are vital to ensure everyone is on the same page. We foster an environment where questions are welcomed and information flows freely, which is crucial for resolving issues quickly and efficiently.

Offer Continuous Support and Training:

Supporting your payroll team with continuous learning opportunities is key to their success. We provide ongoing training and resources to keep your staff at the forefront of payroll management practices, ensuring they remain confident and competent in their roles.

Your Partner in Business Payroll Management

Effective payroll management is more than just paying your employees on time; it’s about creating a system that supports business stability and employee satisfaction. At Miami Beach CPA Firm, led by Joseph Hanlon, a seasoned expert in Payroll tax issues miami, we understand the intricacies of payroll management. With our expert payroll services, along with forensic accounting and IRS audit representation in Miami, we are equipped to help your business not only meet but exceed payroll expectations.

Ready to streamline your payroll processes?

Contact us today to learn how our comprehensive payroll solutions can transform your business operations. Under Joseph’s guidance, let us help you build a payroll system that supports your business goals and keeps your team happy.

High-tech industries are continuously evolving, driven by rapid innovation, globalization, and technological advancements. As businesses in these sectors grow and face increasingly complex challenges, financial planning plays a critical role in navigating these shifts. The future of financial planning in high-tech industries will focus on adapting to emerging trends, leveraging advanced financial tools, and supporting strategic growth.

1. Embracing Technological Advancements in Financial Planning

The rise of automation, artificial intelligence (AI), and data analytics has revolutionized financial planning. High-tech companies are increasingly integrating these technologies into their financial processes to enhance accuracy, streamline operations, and make informed decisions. AI-powered forecasting tools, for instance, allow for real-time data analysis, providing businesses with predictive insights to optimize financial strategies.

For high-tech businesses in Miami, utilizing specialized accounting software consulting in Miami can help streamline operations and improve financial decision-making. Leveraging platforms like QuickBooks setup, Peachtree setup, and SAP accounting in Miami enables companies to automate tedious accounting tasks, improving efficiency and allowing financial professionals to focus on strategic growth initiatives.

2. The Role of Agile Financial Planning in Innovation

Agility is a key component in the high-tech industry, where market conditions, customer preferences, and technological trends shift rapidly. Financial planning needs to be flexible enough to adapt to changing business environments. Traditional static financial planning models are being replaced by dynamic and rolling forecasts, allowing companies to adjust their strategies in real time.

A trusted CPA firm in Miami can provide essential financial insights, helping tech companies remain agile in their financial strategies. By leveraging business accounting Miami services, high-tech businesses can make better-informed decisions that drive growth while staying financially healthy.

3. Strategic Growth Through Tax Optimization

For high-tech firms, tax optimization is an essential part of financial planning. Many companies in this sector may qualify for specific tax incentives, credits, and deductions, particularly when investing in research and development. Effective tax planning in Miami can uncover these opportunities, allowing businesses to reinvest savings into innovation and growth.

High-tech companies in Miami can benefit from specialized tax preparation in Miami to ensure they are compliant with tax regulations and able to optimize their tax positions. Working with a professional team that understands the nuances of the tech industry can also help businesses manage payroll tax issues in Miami and ensure smooth business tax preparation.

4. Managing Risk and Ensuring Compliance

Risk management is a critical consideration in the high-tech industry, where businesses face potential threats from cybersecurity breaches, intellectual property theft, and regulatory changes. Financial planners must incorporate risk management strategies to mitigate these threats while ensuring compliance with financial regulations.

For instance, high-tech companies working with confidential data or proprietary technology may require forensic accounting in Miami to investigate and address potential financial discrepancies. In addition, firms that face tax disputes or audits can benefit from IRS audit representation in Miami, ensuring they have the necessary support to resolve issues efficiently.

5. Cash Flow Management for Sustainable Growth

For high-tech companies, managing cash flow effectively is crucial for maintaining operations and funding innovation. Balancing investment in research and development with day-to-day expenses requires careful planning. Financial professionals can help businesses develop strategies to maintain healthy cash flow, identify potential gaps, and secure funding when necessary.

By utilizing bookkeeping services in Miami, high-tech firms can ensure that their financial records are up-to-date and accurate, which is essential for effective cash flow management. Businesses may also benefit from payroll services in Miami to ensure that employees are compensated correctly and on time, without disrupting cash flow.

6. The Importance of Financial Transparency and Accountability

As high-tech companies grow, financial transparency and accountability become more important, particularly for businesses looking to attract investors or partners. Clear and accurate financial reporting is essential for demonstrating financial health and potential for growth.

A reliable CPA services provider can assist in ensuring financial transparency through regular audits and accurate reporting. Additionally, companies in the high-tech sector can benefit from small business accounting Miami services to stay organized and compliant as they scale.

7. Planning for Future Transitions: Mergers, Acquisitions, and Exit Strategies

As high-tech companies continue to expand, many will explore mergers, acquisitions, or exit strategies. Financial planning plays a crucial role in preparing for these significant transitions. Businesses must consider factors like valuation, potential tax implications, and capital structure when developing their financial plans for these events.

Collaborating with experts who specialize in tax resolution and trust tax services in Miami can help businesses manage complex financial transitions. In addition, estate tax services and individual tax preparation in Miami may be necessary for high-level executives or business owners as they plan for their personal financial futures alongside their company’s growth.

Future-Proof Your High-Tech Business with Expert Accounting & Tax Services

At Miami Beach CPA Firm, we specialize in providing tailored financial strategies for high-tech companies. From Tax resolution services Miami to cash flow management, our experienced team helps you navigate complex financial challenges. Contact us today to develop a strategic plan that supports your innovation and drives sustainable growth.